- 28 July 2017

Which City Has Wages Growth Higher Than The National Average?

Brisbane’s population is growing and wages are higher than the national average, data from the latest Census has revealed. The city's population has risen by almost 10 per cent in the past five years from 2.07 million to 2.27 million, according to the Census data released last month.

Brisbane is home to almost half of all Queensland residents.

The weekly average family income in Brisbane was $1821, while the weekly average family income in Australia was $1734, the Census data revealed.

Of the occupied properties in the Greater Brisbane area, 76 per cent were houses; 10 per cent were semi-detached, row or terrace houses or townhouses; and 12 per cent were flats or apartments.

Brisbane’s outer fringes were proving the most attractive to new residents, with North Lakes, in Moreton Bay attracting 72,000 people, an increase of 39 per cent since 2011, making it the fastest growing region in the state.

Ormeau/Oxenford - between Brisbane and the Gold Coast - was the second fastest growing region with its population growing by 28.7 per cent to 121,000 people.

Your 10-second guide to Australian jobs report

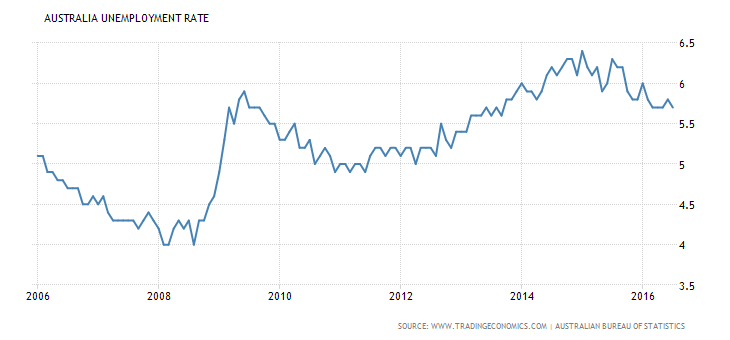

Australia’s jobs report for June is out. After three months of stonking employment gains, coinciding with a clear strengthening in lead labour market indicators earlier in the year, the signs are positive for the jobs market.

Here’s the state of play:

- In May, employment jumped by 42,000 in seasonally adjusted terms, easily surpassing expectations for an increase of 10,000.

- April’s employment change, previously reported as an increase of 37,400, was revised higher to 46,200.

- It was the eighth consecutive month that an increase in employment had been recorded.

- Along with a strong gain in March, the three-month increase in employment jumped to 141,100, the fastest pace of hiring since November 2004.

- Courtesy of the strong lift in hiring, the unemployment rate tumbled to 5.5%, the lowest level since February 2013.

Very strong conditions in our economy to safely invest within!

Have a great weekend and catch you next week!

Troy Gunasekera National Manager

Related Posts

Adelaide’s Growth Curve Is Steepening

Adelaide has entered a new phase of its property cycle, and the data confirms it. According to the Office of the Valuer General, the median house price in metropolitan Adelaide reached $925,000 in the December 2025 quarter. Twelve months earlier, it was $850,000. That represents a $75,000 increase in one year,...

- 12 February 2026

Stop Overthinking Refinancing

By Joe Linco, Club Broker at Property Club When the Reserve Bank of Australia raises interest rates, most borrowers react the same way. Repayments go up, pressure increases, and the issue gets parked for later. That pause is often what costs the most. After the most recent RBA rate rise, many homeowners and property...

- 11 February 2026

Why the February RBA Decision Matters More Than the Headline

With the Reserve Bank of Australia heading into its February interest rate meeting, borrower attention is back on rates, repayments and loan structures. Recent economic data has shifted expectations, and uncertainty is now the dominant theme. Inflation has proven slower to cool than anticipated, and that has placed...