- 6 July 2025

How Roger Galway Turned the ATO into His Side Hustle

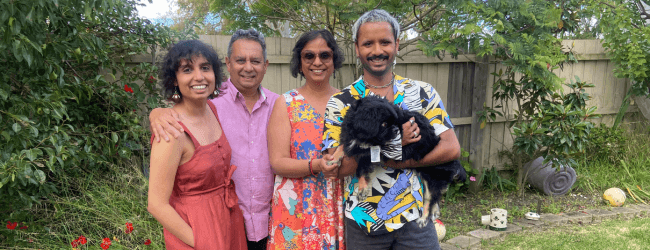

When most people think about building wealth, they picture grinding through long hours, promotions, and maybe a few smart stock picks. Roger Galway had a different idea.

Two decades ago, he realised the nine-to-five grind wasn’t going to cut it. So he started buying property. Now, he owns nine of them across Melbourne, Sydney, Brisbane, Perth, Gold Coast, Cairns and Canberra. The result? A portfolio that not only grows quietly in the background but also hands back around $30,000 a year from the tax office.

“Why pay the government thousands a year when you could have that money working for your future?” Roger says.

The Power of Diversification

Roger didn’t just stick to one postcode and hope for the best. His properties are spread across Australia, a strategy that Property Club teaches for one key reason: markets move in cycles, and they rarely move in sync.

“Different cities grow at different times,” Roger explains. “So by spreading your investments, you ride the highs and buffer the lows.”

It’s a playbook that’s allowed him to keep building year after year without the usual cash flow crunch that sidelines many would-be investors.

Using Tax to Build, Not Bleed

Roger’s favourite part? The tax refund.

“Depreciation benefits and paying interest-only loans were huge,” he says. “That $30,000 tax refund each year reduces our contribution and helps make the portfolio close to cash flow neutral.”

It’s not luck. It’s leverage. He’s using the tax system and structured debt to grow wealth without draining income.

“Most of our properties become close to neutral after five to seven years,” he adds. “You just have to hold long enough and structure things right from the beginning.”

Still Learning After 24 Years

Despite more than two decades of experience, Roger’s not pretending he knows it all.

“I still read every newsletter, attend workshops, and jump into webinars. You pick something up every time,” he says.

His biggest advice for anyone starting out?

“Get into the market as soon as you can. Maximise your borrowing while you can. The longer you wait, the more you hand over to the ATO instead of building your future.”

Property Investment Isn’t About Instant Wins

Roger’s journey isn’t flashy. It’s not viral. But it’s real and built to last. While others stress about tax bills, he’s used the system to his advantage. Now, his portfolio helps fund itself.

Want to learn how Roger did it and how you can too?

Reach out at enquiries@propertyclub.com.au to start your own strategy.

Disclaimer: This article contains general information only and does not take into account your individual objectives, financial situation or needs. It is not intended as financial or investment advice. Please seek professional advice before making any investment decisions.

Related Posts

Adelaide’s Growth Curve Is Steepening

Adelaide has entered a new phase of its property cycle, and the data confirms it. According to the Office of the Valuer General, the median house price in metropolitan Adelaide reached $925,000 in the December 2025 quarter. Twelve months earlier, it was $850,000. That represents a $75,000 increase in one year,...

- 12 February 2026

Stop Overthinking Refinancing

By Joe Linco, Club Broker at Property Club When the Reserve Bank of Australia raises interest rates, most borrowers react the same way. Repayments go up, pressure increases, and the issue gets parked for later. That pause is often what costs the most. After the most recent RBA rate rise, many homeowners and property...

- 11 February 2026

Why the February RBA Decision Matters More Than the Headline

With the Reserve Bank of Australia heading into its February interest rate meeting, borrower attention is back on rates, repayments and loan structures. Recent economic data has shifted expectations, and uncertainty is now the dominant theme. Inflation has proven slower to cool than anticipated, and that has placed...