- 27 July 2022

Article: Investor group celebrates APRA chair’s resignation

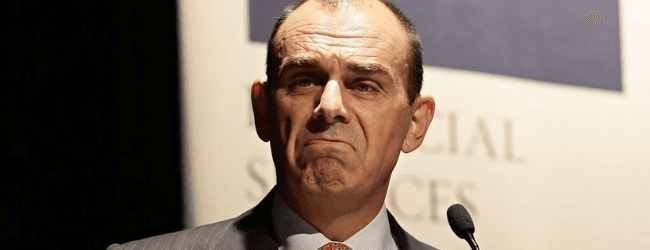

Property Club, an association of Australian property investors, issued a statement following the resignation of Wayne Byres from the top APRA job, saying that it welcomed the news of his tenure ending.

“Mr Byres is directly responsible for the rental crisis impacting on Australian families,” said Kevin Young, president of Property Club.

Mr Young has been a vocal critic of many of APRA’s policies, which the club characterised as “anti-property investor”.

“Punitive measures which he oversaw and that are still in place such as forcing investors from interest loans to principal and interest loans have had a detrimental impact on the Australian property investment market,” Mr Young said.

“They have forced mum and dad property investors out of the property market while discouraging other investors from buying investment property.”

The club sees a direct correlation between APRA’s recent policies and Australia’s low vacancy rate numbers, which have fallen below 1 per cent in some parts of the country, as well as increased homelessness due to rising rents.

“Wayne Byres was totally out of touch with what his negative policies were having on the rental market and as a result we have a rental crisis of his making,” Mr Young said.

It is now up to the federal government to appoint a successor to Mr Byres, and it’s Mr Young’s hope they may name someone who will be more amenable to property investors’ priorities.

“One of the first steps his successor should undertake is to allow investors to maintain interest only loans indefinitely which was the case before [Mr Byres] became chair of APRA and is the case in other developed countries,” he said.

In announcing his resignation, Treasurer Jim Chalmers praised Mr Byres’ record in changing APRA’s public perception.

“Under Mr Byres’ leadership, APRA’s public profile has been strengthened through his commitment to transparency and communication — important in underpinning public trust in the security of Australia’s financial system,” Mr Chalmers said.

“His leadership and expertise has positioned the Commonwealth to respond well to some of the greatest challenges in Australia’s history — most recently in ensuring the stability of the financial system during the COVID‑19 pandemic.”

Mr Byres has been part of APRA since its establishment in 1998 and has served in the position of chair since 2014. He will step down two years before his term is set to end, as the position carries a five-year duration, and Mr Byres was reappointed in 2019.

Related Posts

Why the February RBA Decision Matters More Than the Headline

With the Reserve Bank of Australia heading into its February interest rate meeting, borrower attention is back on rates, repayments and loan structures. Recent economic data has shifted expectations, and uncertainty is now the dominant theme. Inflation has proven slower to cool than anticipated, and that has placed...

What World Data Privacy Day Means for Property Buyers

Each year on January 28, World Data Privacy Day serves as a global reminder of the importance of protecting personal information in an increasingly digital world. While data privacy is often associated with passwords, apps and online security, it is just as critical when it comes to property transactions. Buying or...

From February 2026, Borrowing Gets Harder. Plan Before It Does.

From 1 February 2026 , new lending rules will change how Australian banks assess higher borrowing levels. For many buyers and investors, the outcome will not hinge on the property they choose. It will hinge on access to finance. If buying, investing or refinancing is part of your plans in 2026, this change matters....