- 6 March 2025

Cyclone Alfred: Staying Safe and Protecting Your Tenants

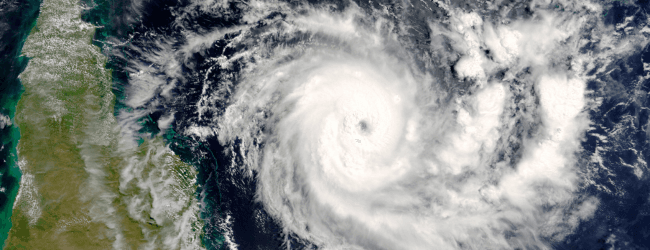

With Cyclone Alfred approaching, many communities in Queensland and New South Wales are facing uncertainty. Extreme weather events like this bring not only immediate risks but also longer-term challenges for property owners and tenants alike.

At times like these, safety comes first. Ensuring you, your loved ones, and your tenants are safe is the highest priority. But once the storm passes, property owners will also need to assess the impact on their investments and understand their responsibilities.

If your property is affected, knowing what to do next can make all the difference in the recovery process. This guide provides clear steps for managing tenancy agreements, assessing damage, and getting properties back to a liveable condition as quickly as possible.

Immediate Priorities: Safety First

Before focusing on property matters, ensure:

- You and your family are in a safe location and have access to emergency services if needed.

- Your tenants are aware of emergency contacts and evacuation procedures.

- You monitor official updates from Bureau of Meteorology (BOM) and local authorities.

Once the immediate danger has passed and it is safe to assess your property, the following steps will help guide you through the process.

What Happens to Tenancy Agreements After a Cyclone?

A natural disaster does not automatically end a lease. If a property is uninhabitable, both landlords and tenants have options:

- Mutual Agreement: The tenancy can end immediately if both parties agree in writing.

- Tenant-Initiated Termination: A tenant can give notice if the property is unsafe or unliveable.

- Landlord Termination: A landlord can issue a notice if the property cannot be lawfully occupied.

In Queensland, tenants must provide a Notice of Intention to Leave (Form 13) within one month of the disaster. In New South Wales, tenants can end the lease via a termination notice or negotiate to stay if partial damage allows. If disputes arise, the NSW Civil and Administrative Tribunal (NCAT) or Queensland Civil and Administrative Tribunal (QCAT) can assist.

Financial Considerations: Rent, Repairs & Insurance

- Rent Adjustments: If part of a property is damaged but still liveable, rent reductions can be negotiated. This should be put in writing to avoid disputes.

- Repairs & Responsibilities: Property owners must restore the property to a habitable condition, including structural fixes, fences, doors, and roofing. However, tenants are responsible for their personal belongings.

- Insurance & Claims: If you have landlord insurance, review your policy before committing to repairs. Some insurers may cover loss of rent, while others may require certain conditions to be met first.

- Temporary Accommodation: Landlords are not obligated to cover tenants' temporary housing costs, though some insurance policies may assist.

Action Plan: What Property Owners Should Do Now

Before the Cyclone Hits

- Review your insurance policies to ensure they cover storm and flood damage.

- Check in with your tenants and provide emergency contact details.

- Secure the property where possible, clearing drains and reinforcing weak structures.

Immediately After the Cyclone

- Only return to the property when authorities confirm it is safe.

- Assess the damage and take photographs for insurance claims.

- Contact your insurer and begin the claims process as soon as possible.

- Discuss temporary arrangements with tenants if they are unable to return.

Long-Term Recovery

- Organise repairs with licensed professionals and ensure all work meets safety standards.

- If necessary, negotiate rent reductions or new lease agreements with tenants.

- Review your investment strategy to assess risks and resilience against future events.

We’re Here to Support You

We know that extreme weather events like this can be stressful and overwhelming. If you need guidance on your obligations, insurance claims, or managing tenant concerns, reach out to us at enquiries@propertyclub.com.au or speak with your Property Club mentor.

Our thoughts are with everyone affected by Cyclone Alfred. While recovery can feel daunting, having the right support and information will help you rebuild with confidence.

Related Posts

How Roger Galway Turned the ATO into His Side Hustle

When most people think about building wealth, they picture grinding through long hours, promotions, and maybe a few smart stock picks. Roger Galway had a different idea. Two decades ago, he realised the nine-to-five grind wasn’t going to cut it. So he started buying property. Now, he owns nine of them across...

No Storm Surge Here: Brisbane’s Budget Holds Steady for Investors

In the wake of ex-Tropical Cyclone Alfred, which brought Brisbane its wettest day in 50 years with over 420mm of rain in some suburbs and winds reaching up to 60 km/h, the city faced significant recovery challenges. Despite the extensive damage, including power outages affecting over 56,000 homes and businesses,...

Stamp Duty Doesn’t Have to Hurt — Here’s Where It Doesn’t

Stamp duty isn’t the most exciting part of buying property, but it can seriously shape what you can afford and how quickly you can grow your portfolio. A national report by SQM Research for the Real Estate Institute of Australia (Stamp Duty: The Relationship to Australian Housing Affordability and Supply, October...