- 29 July 2016

What Will Australia’s Low Inflation Reading Mean For Interest Rates And Property Markets?

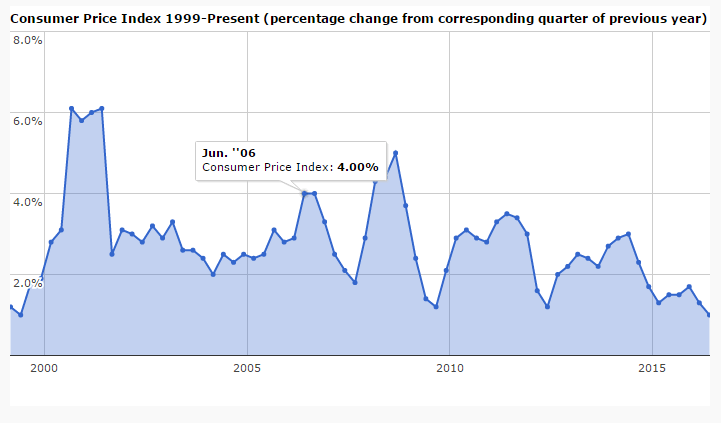

Consumer prices in Australia rose 1.0 percent through the year to the June quarter of 2016 from 1.3 percent in the previous quarter and slightly below market consensus. It was the lowest inflation rate since the second quarter 1999. On a quarterly basis, consumer prices rose 0.4 percent, following a 0.2 percent drop in the March quarter and in line with expectations.

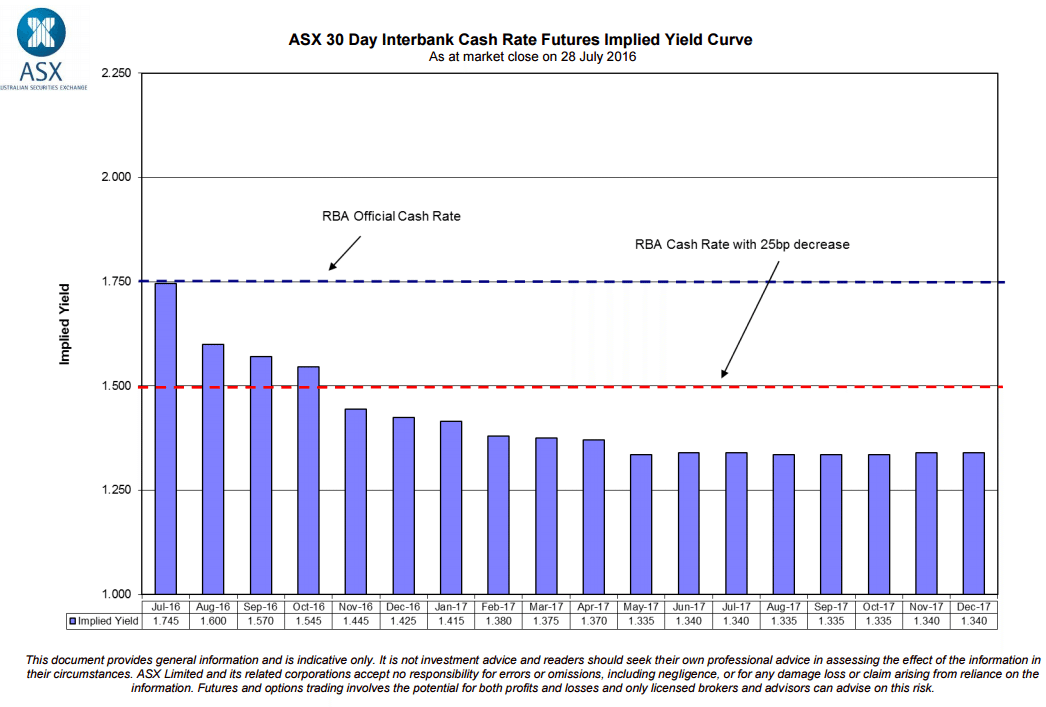

Looking at the markets on the futures for the cash rate, there is still a high probability of the rate dropping another 0.25% by the end of the year!

There was also more focus on our property markets this week, in terms of superannuation options.

The family home may for many hold the overlooked value when it comes to fund or financially support their retirement savings, an option strengthened by constant tinkering and growing complexity of superannuation.

Peter Szabo, Homesafe Solutions managing director, said that all these issues would rather turn Australians to the family home as an option "seeing it as a better, simpler and relatively more secure alternative".

The provider of the retirement solutions noted that the ongoing fiddling with the legislation around superannuation fuelled a lack of confidence in the system and drove Australians to seek other alternatives despite the federal government's objectives to strongly encourage people to fund their own retirement through industry, retail, corporate and SMSF structures.

Peter Szabo, Homesafe Solutions managing director, said that all these issues would rather turn Australians to the family home as an option "seeing it as a better, simpler and relatively more secure alternative".

As such, the overlooked value stored in the family house, an equity that can be accessed to supplement the underfunded superannuants and low income retirees, was expected to gain more significance.

"Continuing socio and economic uncertainty is the new norm for today's working Australians that these factors will impact on their ability to contribute sufficiently to superannuation," he said.

"Add in constant government tinkering with the superannuation system and owning a family home can prove to be a much needed asset lifesaver for ongoing financial wellbeing when it is time to face an underfunded retirement."

And finally, when you couple this with the updated facts through that 1 in 10 capital city home sales over the past year were over $1 million, we can see our property markets continuing to be very health moving forwards!

Property Club members have continued to benefit from our extensive Research and more, with 5,000+ members in our Millionaires Club!

Property Club members are having a lot of success with Club research assisting them to acquire a residential property portfolio, that will give them more choices in retirement!

Make sure you contact your Property Mentor to assist you to catch the wave as well!

Have a great weekend and catch you next week!

Warm Regards,

Troy Gunasekera National Manager Property Club

Related Posts

Adelaide’s Growth Curve Is Steepening

Adelaide has entered a new phase of its property cycle, and the data confirms it. According to the Office of the Valuer General, the median house price in metropolitan Adelaide reached $925,000 in the December 2025 quarter. Twelve months earlier, it was $850,000. That represents a $75,000 increase in one year,...

- 12 February 2026

Stop Overthinking Refinancing

By Joe Linco, Club Broker at Property Club When the Reserve Bank of Australia raises interest rates, most borrowers react the same way. Repayments go up, pressure increases, and the issue gets parked for later. That pause is often what costs the most. After the most recent RBA rate rise, many homeowners and property...

- 11 February 2026

Why the February RBA Decision Matters More Than the Headline

With the Reserve Bank of Australia heading into its February interest rate meeting, borrower attention is back on rates, repayments and loan structures. Recent economic data has shifted expectations, and uncertainty is now the dominant theme. Inflation has proven slower to cool than anticipated, and that has placed...