- 28 October 2016

How To Boost Your Super Before Rule Changes Kick In

An interesting summary of the superannuation changes in the Australian news this week:

With the federal government’s draft legislation on the proposed changes to superannuation now released to the market, there is no time to wait for people approaching retirement who want to boost their superannuation.

With the proposed cuts in the concessional super caps, employees in particular have to act now if they want to take advantage of higher salary sacrifice opportunities available this financial year.

At the moment, people 49 and over can put as much as $35,000 in a year into their super on a concessional basis (including the compulsory 9.5 per cent super guarantee contributions). The figures goes down to $25,000 a year for people of all ages from July 1.

From July 1 the post-tax super contribution cap goes down from $180,000 a year to $100,000. And when the total amount in super hits $1.6 million, no more post-tax contributions can be made at all.

Planning for your retirement with your superannuation and 'outside super' assets is important to always keep an eye on.

Property Club has licensed financial advisers that can assist members to navigate through this.

Australia’s retirement system ranks third globally, gets B+

While we are on the topic; can you believe that (based on the system we have in place today: there are recommendations to lift the superannuation guarantee and keep citizens working longer?!

The study is produced annually by international consulting firm Mercer in partnership with The Australian Centre for Financial Studies, which is based out of Monash University in Melbourne.

In 2016 Australia’s overall index value fell from 79.6 in 2015 to 77.9.

Professor Rodney Maddock of the Australian Centre for Financial Studies said : “Australians are living longer, living larger portions of their life in retirement and spending more in retirement, so we need to be well-placed to ensure fulfilling, adequately-funded retirements.”

Are Property Club member more successful than the rest?. . . yes!!

Property Club members have continued to benefit from our extensive Research and more, with 5,000+ members in our Millionaires Club!

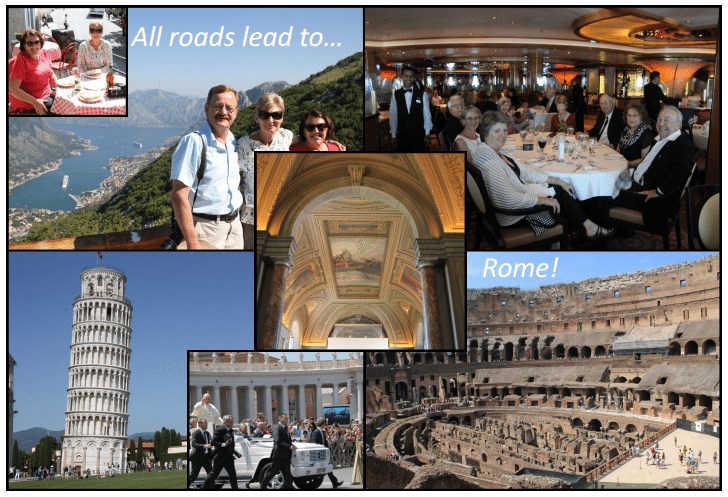

Property Club members are having a lot of success with Club research assisting them to acquire a residential property portfolio, that will give them more choices in retirement!

Make sure you contact your Property Mentor to assist you to catch the wave as well!

Have a great weekend and catch you next week!

Warm Regards,

Troy Gunasekera National MAnager

Related Posts

Adelaide’s Growth Curve Is Steepening

Adelaide has entered a new phase of its property cycle, and the data confirms it. According to the Office of the Valuer General, the median house price in metropolitan Adelaide reached $925,000 in the December 2025 quarter. Twelve months earlier, it was $850,000. That represents a $75,000 increase in one year,...

- 12 February 2026

Stop Overthinking Refinancing

By Joe Linco, Club Broker at Property Club When the Reserve Bank of Australia raises interest rates, most borrowers react the same way. Repayments go up, pressure increases, and the issue gets parked for later. That pause is often what costs the most. After the most recent RBA rate rise, many homeowners and property...

- 11 February 2026

Why the February RBA Decision Matters More Than the Headline

With the Reserve Bank of Australia heading into its February interest rate meeting, borrower attention is back on rates, repayments and loan structures. Recent economic data has shifted expectations, and uncertainty is now the dominant theme. Inflation has proven slower to cool than anticipated, and that has placed...