- 14 December 2018

ABC 7:30 - A Wealth Hazard?

This week has seen a 3 part series on the ABC called 'House of Cards', which was looking broadly at the Australian Property Market and painting it in dark colours using the fear of negative media. Click to watch:

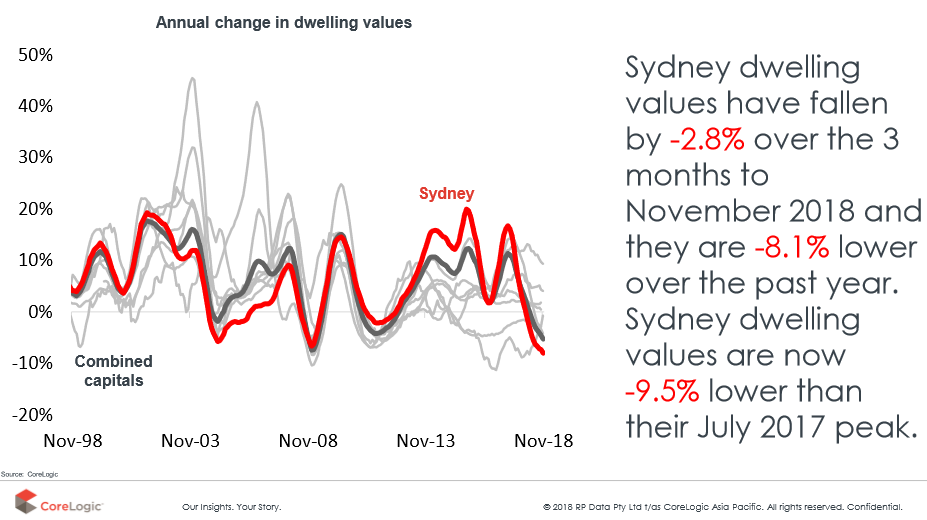

Folks, forget all of that - we all know negativity is the basis of all media so let me set the record straight. All we are seeing here is history repeating itself and property going through a normal cycle. To prove this we will look at the 20-year chart of Sydney property and you can see all the hysteria by the ABC and the selected guests is unwarranted.

Looking back you can see in 2002 and 2003 property prices actually went up higher than they did recently in Sydney, in fact, one year prices went up 22%. You can see then the market as they do all around the world and in Australia corrected. They cannot sustain these big increases, and so you can see in 2003/2004 the market returned to norm and in fact, we have shown here the next 9 years though prices went up and down they were the same 9 years later. Then, of course, Sydney went through its well-deserved boom, no hysteria was needed, it was just a normal thing and of course, property prices corrected.

They would have corrected earlier but APRA got in the way and restricted supply. If you were a builder, you were wanting to add to the supply in Sydney but you held back because you knew your buyers could not get funding, so the boom actually continued a year longer than it should have.

That is all that is happening again now, we have got Sydney prices coming back to the long-term trend line, they are going to fall a little bit more and I think in fact that Sydney will be good buying again in about 2 years time.

No need for overreaction, this is simply Sydney going through it’s a normal cycle.

Now, the big question is… What other areas are going up in their cycle? Will APRA and Reserve Bank overreact when they have their boom? I don’t think so. It is only an overreaction to the Sydney market in particular that draws the attention of APRA.

So where is the next Sydney boom? Wise property investors look at all markets to make sure they get in at the early stage of the boom and not at the end of it which is happening now in Sydney and Melbourne and that is why we have the Property Club. We are here to educate.

Happy Investing,

Kevin Young

Related Posts

Adelaide’s Growth Curve Is Steepening

Adelaide has entered a new phase of its property cycle, and the data confirms it. According to the Office of the Valuer General, the median house price in metropolitan Adelaide reached $925,000 in the December 2025 quarter. Twelve months earlier, it was $850,000. That represents a $75,000 increase in one year,...

- 12 February 2026

Stop Overthinking Refinancing

By Joe Linco, Club Broker at Property Club When the Reserve Bank of Australia raises interest rates, most borrowers react the same way. Repayments go up, pressure increases, and the issue gets parked for later. That pause is often what costs the most. After the most recent RBA rate rise, many homeowners and property...

- 11 February 2026

Why the February RBA Decision Matters More Than the Headline

With the Reserve Bank of Australia heading into its February interest rate meeting, borrower attention is back on rates, repayments and loan structures. Recent economic data has shifted expectations, and uncertainty is now the dominant theme. Inflation has proven slower to cool than anticipated, and that has placed...