Property Tip #22

Do be engaged with the body corporate where appropriate, to be involved and direct maintenance and improvements as required.

Do be engaged with the body corporate where appropriate, to be involved and direct maintenance and improvements as required.

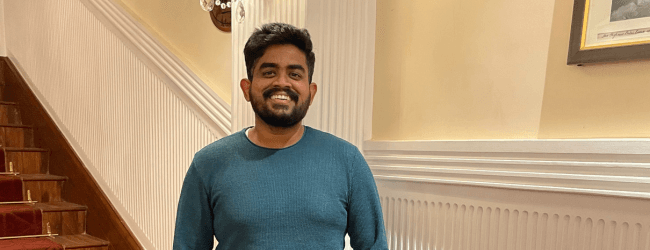

This is the story of Venu, and how he found success as a property investor after joining Property Club.

Venu moved to Brisbane in 2013 to undertake his Masters in IT before finding work as a software developer. At first, he was not looking into property investments and didn’t seek out any education on the topic as he was focused on paying off his student loan.

The years rolled by and towards the end of 2017, he began researching how to become wealthy. He didn’t want to become stuck in a routine lifestyle while relying on a government pension after retirement.

Venu wanted to take charge of his life and started borrowing books on personal finance from the local library, listening to podcasts, researching property investing and investing in Exchange-Traded Funds (ETFs). While researching online, he came to know that Property Club was conducting property investment workshops and went to one in August 2018.

At first, Venu was quite sceptical, but was warmly welcomed by Property Mentor Fred Zanette who explained more about the benefits of investing in property. However, he still had a few obstacles to work through like minimum deposit and permanent residency. Venu attended as many meetings as possible so he could motivate himself and learn more.

Never once did Fred or anybody from the Property Club try to push a property sale. Venu was astonished by the welcoming environment that Fred and the Property Club provided even though he was not in a position to buy a property at that stage.

Later, Venu was introduced to Harinder, an excellent finance broker, who provided tips on the market. Venu kept attending the workshops and came to the Property Club weekend conference that was conducted by Kevin Young in May 2019.

Venu gained a lot of knowledge and got to interact with many fellow property investors. He found it inspiring and, at the same time, a bit scary. He took away good notes from the weekend event and eventually used that knowledge to obtain immense financial gain. But more on that later...

Venu started saving rigorously in his ETF portfolio through micro investing apps. Finally, he got his permanent resident visa in February 2020. So, the only other obstacle in front of him was an initial deposit. He had saved enough during the Covid lockdowns plus was eligible for the government’s first home owner grant.

These savings eventually allowed Venu to buy a townhouse in QLD in Dec 2020 as his principal place of residency. Fred and Harinder were incredibly supportive and helped Venu through the purchase of his first home. Venu was so proud of himself; finally witnessing all of his efforts and sacrifices pay off.

After settling the property, Venu went through his original notes and found one of the crystal ball predictions at the May 2019 conference. It predicted that the rates would be fixed for the next 3-4 years. With this information, Venu split his home loan into two loans - one variable rate loan for $100K and one fixed rate loan for $300k.

Months passed. Venu got married in 2021 and his partner’s Visa application was also difficult to obtain in Australia. As a result, he was left on a single income to pay for the mortgage. Fixing the mortgage loan for 4 years helped Venu with the rate rises—incredibly helpful advice offered to him by Property Club.

Overall, Venu really loved what Property Club did for his family, and he made the decision to become a mentor to learn more and help others in the process. His only regret is that he didn’t start his investing journey earlier.

Luke and Jess came to Property Club on the recommendation of Jess's father, who had built his own investment portfolio with the Club’s guidance. While their journey started with a few unexpected hurdles, the couple ultimately walked away with a strong result and a much deeper understanding of property investing....read more about Luke & Jessica Halbert

Finding a way into the investment property market can often feel like an obstacle too high to overcome. That was certainly the case for Jodrell D’Souza and Janice Mendonca, whose previous experience trying to become property investors was met with nothing but frustration and dead ends. That all changed when they...read more about Jodrell D’Souza and Janice Mendonca

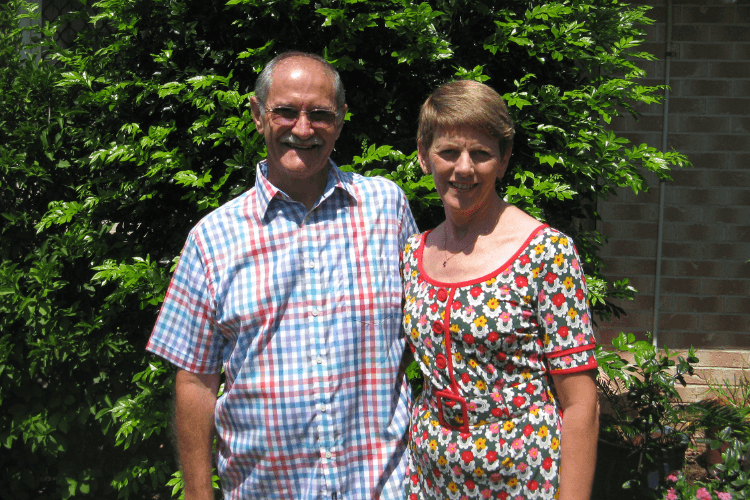

Fred and Linda Zanette are looking forward to a very comfortable retirement through their successful property investment with the Club. Starting their journey later in life, the couple says the best thing about joining Property Club is they no longer worry about their retirement, like so many Australians who are...read more about Fred and Linda Zanette

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.