Property Tip #22

Do be engaged with the body corporate where appropriate, to be involved and direct maintenance and improvements as required.

Do be engaged with the body corporate where appropriate, to be involved and direct maintenance and improvements as required.

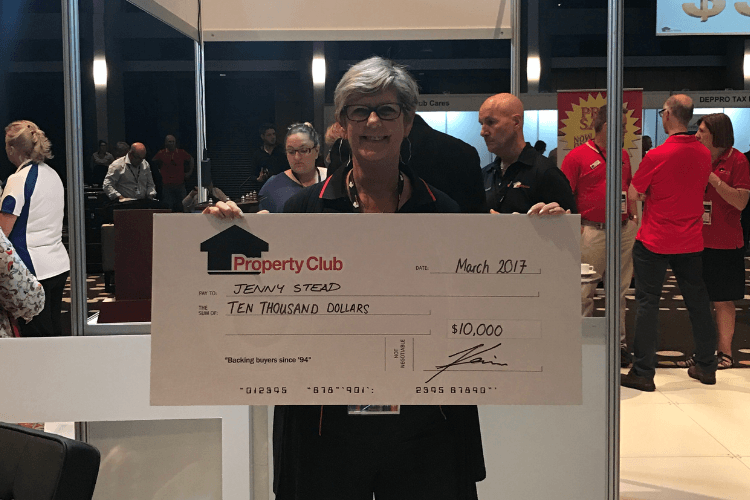

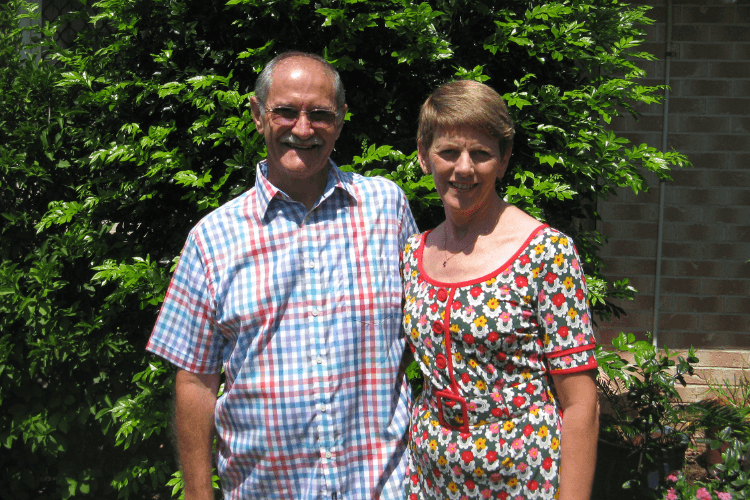

What started out as a simple holiday conversation has evolved into a life of adventure and travel for Jenny and Bob Stead, all thanks to investing with the help of Property Club.

Fifteen years ago Jenny Stead and her husband, Bob, were holidaying with friends when Property Club came up in conversation. Life as they knew it was about to change – for the better.

The couple were both around 50 years old, and retirement had begun to transform from something in the distant future to a looming reality. However, like most people, the Steads hadn’t really given much thought as to how they would continue to make ends meet once fulltime employment came to an end.

At that time the duo had owned one house, which had been sold when they decided to upgrade to a larger one. However, that initial mention of the Club piqued Jenny’s interest and, once she got back home to Newcastle, she began to Google furiously. From there, she and Bob attended several Club meetings.

The Steads were immediately attracted

to the positive attitude the Club’s members exuded as well as the extensive knowledge readily available to them, and so Jenny and Bob decided to take the plunge.

“At first we couldn’t understand how it could work, but with so many others doing it and succeeding we thought we could do it too.

We needed to do something to help fund

our retirement. We didn’t understand shares, weren’t interested in Bitcoin. We wanted to do something we were interested in, and property fit in perfectly,” Jenny said.

“We had a mortgage that we had pretty much paid down. And although we didn’t have much money saved, we had lots of equity in the house.”

Jenny relished the fact that everyone they met in the Club was happy and not only willing, but excited to help her and Bob kick off their property journey.

After a few weeks of agonising Jenny and Bob decided to start with an EOI on a unit in Brisbane’s Upper Mt Gravatt.

“With the Club’s help and guidance we started buying. We figured we needed to do as much as we could, as quickly as we could. However, we were gazumped as the developer sold externally for $50,000 above what Property Club was selling them for,” Jenny said.

“Instead we jumped in with an off-plan two-bed duplex with study at Yeppoon for $186,000. That settled about 12 months

later in March 2004. While that was being

built we put in an EOI for a house-and-land at Jimboomba, south of Brisbane. It was a four- bed, two bath with a single lock-up garage on a 1000sq m block for $235,785.”

Properties at Biggera Waters, Burpengary,

Cannon Hill and Mudgeeraba in Queensland, Derrimut in Victoria, Guildford, NSW and Gosnells in WA all followed in a variety

of property types – units, duplexes, villas, townhouses and house-and-land packages.

Today, Jenny and Bob’s property portfolio, including their own house, is worth around $4.8 million, while they have $2.9 million in debt LVR at 63 per cent.

“We have a variety of property types in different states – so different markets – around the country to spread the risk, and all were bought with the help of Property Club and its free services. If only we’d known back then not to sell our first home,” Jenny said.

However, it was far from smooth sailing. The Steads had to wrap their heads around the different rules in each state regarding strata, as well as tackle finance and high interest rates, refinancing, water-proofing issues in some properties, and dealing with the tenants from hell.

“All our loans were interest only. Some we arranged ourselves, others we did using a broker. Some were at 90 per cent and some at 80 per cent and one was through a Hybrid Family Trust,” Jenny said.

“It was information overload at times and things did fall through the cracks from time to time. But we used the Property Management Program constantly, which was very helpful and gives a good snapshot. We now provide this to our accountant each year.

“Essentially, we had to be organised. But all that you need is provided free of charge by Property Club.”

Looking back on the past 15 years, the

Steads have accumulated a wealth of property knowledge themselves, which Jenny is passing on through her work as a Property Club Branch Manager looking after Newcastle, the Central Coast, and parts of Sydney and the ACT.

When asked what she’d do differently if she had her time again, Jenny’s initial advice was simple: just start.

“We should have started sooner, and we didn’t purchase to our borrowing capacity,” she said, adding in a few lessons they learned the hard way.

“We also over-exposed in South East Queensland. We should have bought in other states more quickly. We didn’t buy above median price and didn’t always buy close to CBD areas.

“In hindsight, we could have made better decisions, but we did what felt was right for us at the time.”

Jenny said she and Bob had stopped accumulating property, as they had both retired from full-time employment. However, they were currently paying little to no tax and were living off their superannuation so as to allow the properties to grow and LVR reduce.

Further, the freedom granted to the Steads, now both in their 60s, from their properties allows the duo to focus their time on the important things: time with their children and grandchildren, the capacity to fully pursue hobbies and the freedom to afford to travel when and where they want to.

“Persistence is the quality I most admire in other people. Most people give up when the going gets tough, but as a property investor we need to be resilient and persistent,” Jenny said.

So, what does the future hold for the Steads?

“In the next five years I’d love to purchase more property as for some reason I wanted 11 but only have 10,” Jenny said.

“It’s rewarding to have achieved something worthwhile, creating a portfolio of property we can use to fund our retirement and help our family. And to not be a burden on society by living on a pension.”

Luke and Jess came to Property Club on the recommendation of Jess's father, who had built his own investment portfolio with the Club’s guidance. While their journey started with a few unexpected hurdles, the couple ultimately walked away with a strong result and a much deeper understanding of property investing....read more about Luke & Jessica Halbert

Finding a way into the investment property market can often feel like an obstacle too high to overcome. That was certainly the case for Jodrell D’Souza and Janice Mendonca, whose previous experience trying to become property investors was met with nothing but frustration and dead ends. That all changed when they...read more about Jodrell D’Souza and Janice Mendonca

Fred and Linda Zanette are looking forward to a very comfortable retirement through their successful property investment with the Club. Starting their journey later in life, the couple says the best thing about joining Property Club is they no longer worry about their retirement, like so many Australians who are...read more about Fred and Linda Zanette

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.