Property Tip #22

Do be engaged with the body corporate where appropriate, to be involved and direct maintenance and improvements as required.

Do be engaged with the body corporate where appropriate, to be involved and direct maintenance and improvements as required.

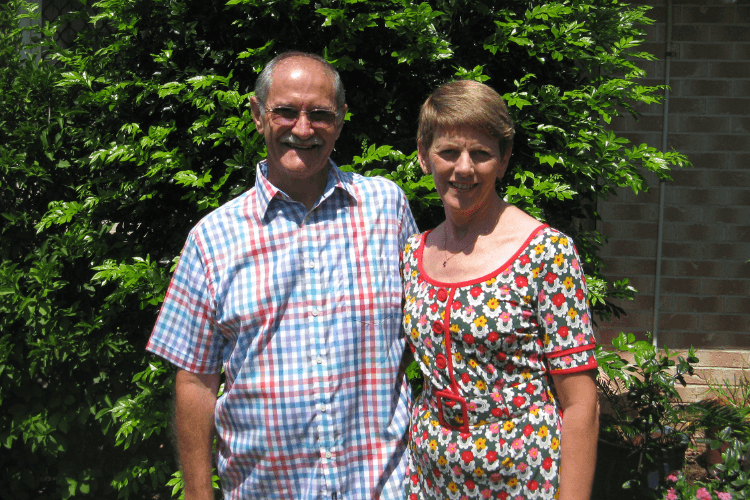

Fred and Linda Zanette are looking forward to a very comfortable retirement through their successful property investment with the Club.

Starting their journey later in life, the couple says the best thing about joining Property Club is they no longer worry about their retirement, like so many Australians who are nearing retirement age. Instead, Fred and Linda are looking forward to an active and fun-filled retirement where they can enjoy travelling in Australia and overseas.

Meeting in a social ballroom dancing class in 1999, the couple both came from previous marriages and chose to live in Ormiston when they married in 2004. Fred was previously employed by Brisbane City Council and Linda is a registered nurse with a post-graduate degree as a credentialled diabetes educator.

In the beginning, they joined the Club as investors to build wealth for retirement but that all changed in 2011 when, after being offered

a redundancy package by his employer, Fred decided to take the plunge and become a full- time Property Mentor.

“I was a single dad in 1991, looking after my eldest son, and it was in 1996 when I finally realised that, if I did not do something different, I would be struggling with my retirement

and relying solely on the pension. I decided residential property investment was my opportunity to build wealth,” Fred explains.

Fred joined an investment club at a cost of $300, where the strategy was to purchase properties below the valuation price. The club only lasted 12 months and Fred lost his money.

“I bought two units at New Farm in 1999 before joining Property Club. They set me

up with lines of credit, depreciation schedules and a rental guarantee. It was still quite nerve- wracking for me. Many sleepless nights later,

I finally felt comfortable with the purchase!” Fred laughs.

Fred and Linda soon realised they needed a property portfolio but did not know where to buy or how to successfully invest in additional properties. This was until they were invited to join Property Club in 2006.

Fred and Linda say the education and support offered gave them the confidence and experience to accelerate their investment property purchases.

“We now have a portfolio of seven investment properties: six in South East Queensland and one in Melbourne, which are all cash flow neutral after tax,” Fred says.

Now 69 years old, Fred says some advice he would give to early-stage property investors

is to start as early as possible. While his investment journey began at 56, he says he and Linda are thrilled to have been able to build a sustainable property portfolio at a later stage in life.

“It is very important for young people to

get started on the property journey as soon as humanly possible. Using government grants and stamp duty concessions, turn your property into an investment property and you are at least on the treadmill as property prices increase,” he advises.

Surprisingly, Fred and Linda recount their first impression of the Club as being quite negative.

“Our first impression of the Club was that it was too good to be true and there had to be a 'gotcha',” Fred recalls.

The couple soon came to believe the Club was genuine in its intention to help ordinary Australians build passive wealth for retirement.

“We were assigned a Property Mentor who did not pressure us to buy a property but supported us until we felt comfortable to do so,” Fred says. Now, as a seasoned investor, Fred is aware

of trends in the investment property market. “I see changes in dwelling sizes going forward. Eighty per cent of renters are

singles/couples yet 80 per cent of investment properties are three-, four- and even five- bedroom dwellings," Fred says. "There will be a shift to smaller dwellings and a focus on investor-provided smaller size, low-cost rental accommodation."

When the couple isn't working and investing, they enjoy outings and holidays in the great outdoors and the occasional overseas trip.

They cite the most value qualities in each other as honesty, sincerity and a sense of fair play, which is perhaps what makes them such a dynamic duo in the investment property game.

Luke and Jess came to Property Club on the recommendation of Jess's father, who had built his own investment portfolio with the Club’s guidance. While their journey started with a few unexpected hurdles, the couple ultimately walked away with a strong result and a much deeper understanding of property investing....read more about Luke & Jessica Halbert

Finding a way into the investment property market can often feel like an obstacle too high to overcome. That was certainly the case for Jodrell D’Souza and Janice Mendonca, whose previous experience trying to become property investors was met with nothing but frustration and dead ends. That all changed when they...read more about Jodrell D’Souza and Janice Mendonca

Chandika is a new Property Club member who lives with his wife Roshini and daughter in the ACT. Chandika and Roshini have been interested in property investment for many years but did not know where to start. They were referred to Property Club by another member who had a great experience. Chandika was allocated a...read more about Chandika Dassanayake

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.