Property Tip #22

Do be engaged with the body corporate where appropriate, to be involved and direct maintenance and improvements as required.

Do be engaged with the body corporate where appropriate, to be involved and direct maintenance and improvements as required.

Property Club member AJ Jones is living proof you don’t need dual incomes to establish a successful property portfolio.

AJ Jones began her property investment journey at the tender age of 22. The public servant purchased her first three investment properties (townhouses in Runcorn and Wynnum West) with her parents between 2004 and 2007. She then purchased her own home in Ipswich in 2009 using equity from these investments. It was a decision that resulted in what AJ refers to as a “financial tangle”.

“My home and two investment properties purchased with my parents ended up being cross- collateralised, even though we had never intended to do this,” she explains.

“The broker either didn’t know how to set up loans properly for investing, or simply didn’t want to because it was easier or better for him – and we didn’t really think too much of it at the time.

“Eventually, I ended up in a position where I could go no further because of how banks assess your borrowing capacity and servicing when you co-own property (i.e. count your portion of the rental income but assess you against the risk of the entirety of the loans).”

AJ had effectively hit a wall in terms of her borrowing capacity. For the next five years she kept trying, talking to the same broker and getting the same message – ‘no one will lend you anything, you cannot do anything.’

Then, in early 2014, AJ’s parents began talking to Property Mentor Fred Zanette.

“Fred is an incredible person. He is a huge support to me both personally as a friend and professionally as my Property Mentor,” AJ says.

“Fred was instrumental in helping us rectify the financial mess of our cross-collateralised loans. Now, with advice from people who knew what they were doing, a Club-affiliated broker helped us separate everything out. I kept my own home and bought my parents’ share of a townhouse at Wynnum West.

“Eventually I was able to look at borrowing funds again in early 2016 for two properties – one in my own name and one in a SMSF that I would set up. I was ecstatic, to say the least! Then the ‘APRA effect’ started to really become evident, and I went from being able to afford a new investment property in my own name to apparently not being able to afford the debt I had been easily servicing for the last 10 years. After so much time, expense and hassle to get myself sorted financially, it felt like a huge kick in the guts, and I was so angry and upset.”

Not being able to borrow in her own name, AJ went about her plans to set up her SMSF and bought her next property (a unit in Nundah) that way.

“It would have been really great to have been able to have another in my own name, too (I had a unit picked out in Perth), but it seems that wasn’t meant to be,” AJ says.

“With the timing, it seems I was fortunate to be able to even do the one in my SMSF, so I am grateful. While that last purchase was happening, I managed to refinance my existing loans again and draw equity out of my own home to do some major backyard landscaping, installing huge retaining walls, which has again increased the value of my home.”

While AJ is still unable to purchase another investment property, the good news is that if she were to turn her home into an investment property, she would be able to borrow funds to buy another home to live in.

“Considering I am a keen renovator, my next move is to buy a well located property (under market value) to live in and renovate, with a view to either sell or refinance to go again in a couple of years’ time,” she explains.

“Selling goes against my grain, but as I have learned, you need to do what you have to in order to achieve your ultimate goals.”

While property is AJ’s retirement strategy, she says she would love to make property investment her “bread and butter” too.

“I don’t want to work full-time doing something I do not truly enjoy,” she says.

“The quicker I can grow my portfolio, the quicker I can do the work I want to do (because then it’s not work, right?), and the more lovely holidays I can take.

“I love travelling – I am conquering New Zealand one wine region at a time. I love my wine and enjoy fine dining. But I am equally at home digging in dirt to connect drainage pipes and painting walls – I can’t shake the renovating bug!”

AJ says she is “deadset keen and hungry” to keep moving in her property journey, to not experience staleness again, to be happy doing what she loves and to make her life (and her beloved dog’s life) all the better.

“Every step forward, however tiny, is actually massive, and I have learned to grab each little increment when I can,” she says.

“Even when things seem hopeless, there is hope; you just need to keep looking until you uncover the next gold nugget that will push you along.

“My advice for other early-stage investors would be not to waste time. Get the best advice you can from people who are successfully investing in property. If the numbers make sense, go for it.”

Asked what she would tell someone considering buying their first investment property, AJ says it’s vital to educate yourself and take advantage of Property Club’s workshops and free services.

“If it sounds like something you want to do but have doubts, ask questions, attend workshops, get answers to either satisfy or justify those doubts, so you can make the right decision for you,” AJ says.

“Do not hesitate if you decide on property as your retirement strategy. You might think it is expensive now, but it will only get more expensive in the long run.”

Luke and Jess came to Property Club on the recommendation of Jess's father, who had built his own investment portfolio with the Club’s guidance. While their journey started with a few unexpected hurdles, the couple ultimately walked away with a strong result and a much deeper understanding of property investing....read more about Luke & Jessica Halbert

Finding a way into the investment property market can often feel like an obstacle too high to overcome. That was certainly the case for Jodrell D’Souza and Janice Mendonca, whose previous experience trying to become property investors was met with nothing but frustration and dead ends. That all changed when they...read more about Jodrell D’Souza and Janice Mendonca

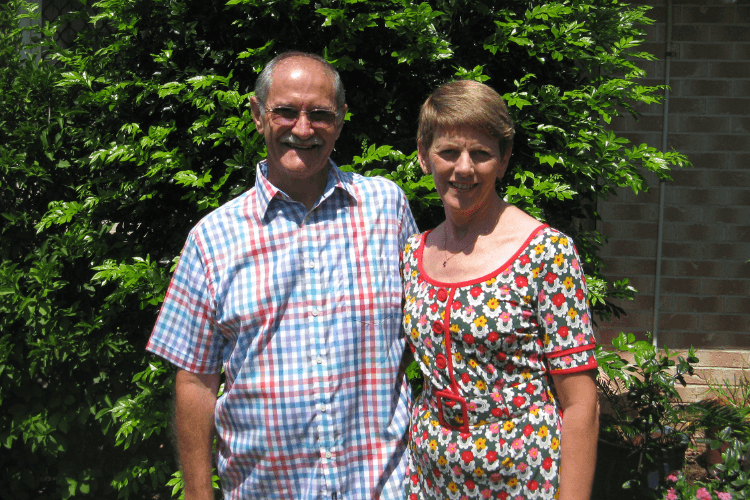

Fred and Linda Zanette are looking forward to a very comfortable retirement through their successful property investment with the Club. Starting their journey later in life, the couple says the best thing about joining Property Club is they no longer worry about their retirement, like so many Australians who are...read more about Fred and Linda Zanette

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.