- 23 Oct, 2016

Doom And Gloom Or Boom?

13,000 a week now not employed! Thanks to you, Mr. APRA! 18 months ago I predicted that APRA would have an effect on unemployment.

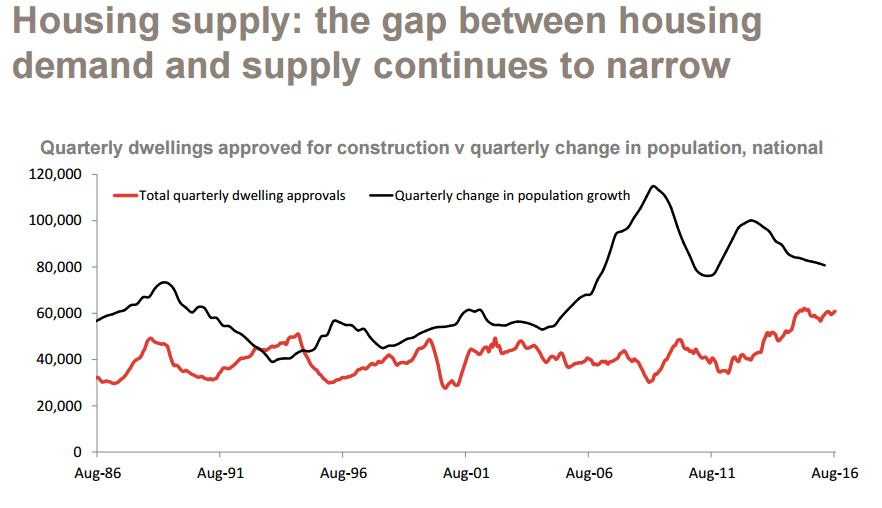

The media, of course, are keen to present negative information rather than educate. They're making a big issue of the impending collapse of the property market from oversupply. They're pointing to the fact that there are ninety-two thousand units coming on the market in the next twelve months and then feverishly pointing to two hundred and twenty-two thousand coming on over the following two years.

The facts!

This sounds a lot but needs to be put into perspective. Each year we supply between one hundred and eighty and two hundred and twenty thousand new properties!

So while the numbers sound huge, they're not when you put it in perspective with historical supplies.

The elephant in the room though is APRA's inspired shortage that will lead to an increase in price. It's ironic that APRA is causing the property boom they purported to change the lending rules to stop! It's an example of what happens when you get a career bureaucrat out of their depth. It's what you get when you have them meddling in a market without first doing their due diligence. I have asked my member of parliament for any research paper APRA may have done before bumbling into restricting mortgages. They can't find any research paper from APRA!

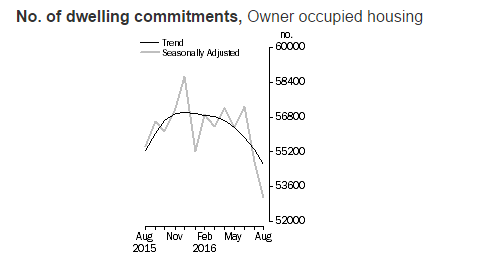

As I have brought up many times, in particularly when Byers started on his attack on investors, the supply chain is now starting to falter. Council approved developments are not proceeding. Councils are not processing as many development approvals(DA's) to building approvals (BA’s). Thousands of BA sites are stalled along with their job creation potential. Jobs that the RBA badly needed to replace the marginal jobs. Again the bureaucrats in RBA lost sight of this stated objective when they feverishly added their support to Byers' bungling attack on investors.

Mortgages to investors are about a third of the market. APRA has squeezed this third of the market to just be 10% of buyers! Fewer buyers, fewer supply, the higher the prices!

APRA's actions were extensively designed to contain runaway prices in Sydney and to a lesser extent, Melbourne. So they bought out a law across all of the Australian property markets that one group of buyers could only be restricted to a 10% increase in volume. This crazy logic was used by the RBA in the early 2000's to stop the then price boom in Sydney and Melbourne. They crazily raised rates, affecting all of Australia. What happened? Prices continued to rise in Sydney and Melbourne because it was their time in the cycle. What happened then? Supply flooded into the market, mostly from investors. The market then with its extra supply, corrected. Annual price jumps faded to minimal and indeed many years just a flat market from this extra supply.

So looking through the figures you can see that this extra supply hasn't come into Sydney. So, Sydney's correction hasn't happened. This is the Byers' factor. He has created an extension of the property boom rather than killing it.

The future.

Back in 1985 we had Keating similarly bungle into the property market. Two years later, on the back of falling government incomes from taxes and levies, fees and charges, he was forced to reinstate depreciation as a tax deduction - and actually accelerated it to encourage supply and the aforementioned government income. Similarly, RBA's illogical rate increases from 2000's were eventually repealed, as were RBA's foolish rate rises in 2009. These too were short lived.

Older readers will remember that your Club, in 2009 picketed all RBA offices month after month calling for the RBA to stop increases and instead reduce rates to 2.25%. Unemployment then was 4.3%. The RBA didn't see any logic in our claims until our prophecy of 6% unemployment was hit.

So all of these government blunderings that failed the common sense test, eventually are reversed. It usually takes eighteen months for reality to hit. So it is now due for Byers to admit the error of his ways and repeal the restriction on property investors. Time to allow supply to come into the market where it is needed (not city centers). Time to increase local, state and federal tax incomes. Time to increase construction jobs and the flow on effect (furniture, fittings, carpets etc).

The media/members of parliament.

The above two sectors are busily focusing on infighting and points scoring on matters not connected with the economy, the deficit or job creation. So it's time for those in slumber land to start waking up and concentrate on the economy and jobs. Let's hope for the sake of the 10% unemployed/underemployed, that it is soon. Let's hope for job creation, that it is soon. Let's hope to stop spiraling property prices, that it is soon.

The result of all of this slumbering is that we now have had three years of zero wage growth with its awful flow through effects in job creation. That's why one in ten people in Australia are underemployed or unemployed - a national disgrace. Maintaining full employment is one of the three charters of the Reserve Bank. Time for them to wake up, recognise it and start mentioning its failure on this score in its monthly minutes.

Going Positive

Should we start a petition to our members of parliament and to a section of the media to force this wake-up? We would love to hear your thoughts comment them on my Facebook page.

Kevin Young

Related Posts

Number of centenarians in Australia soars sixfold, adding new dimension to housing crisis

The number of Australians aged 100 or over has reached a record high of 6,192, a sixfold…

- 23 Apr, 2024

WA house price boom not just about migrants – another population’s exploding

There are now a record 642 centenarians in Western Australia compared to just 67 in 199…

- 22 Apr, 2024

The incentives needed to boost investor activity in Australia

With Australia’s annual rent bill blowing out by $44 billion per annum over the last…

- 11 Apr, 2024

Become a Member Today!

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.