- 20 Aug, 2016

Australian Unemployment - More Work To Do

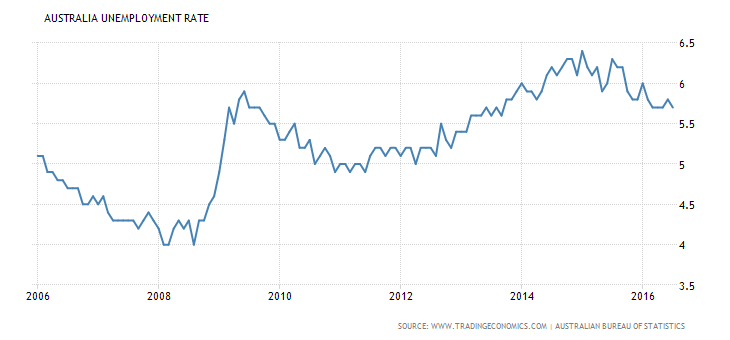

Australian unemployment should be below 5% at the moment. Instead it is still stuck at 5.7%.

While many will be quick to pat themselves on the back for the welcome decline in the unemployment rate from above 6% to 5.7%, this belies the fact that things should be much better than they are.

There is no doubt the Australian economy is firming nicely at the moment. This is the driver of declining employment. This was already happening however several years ago, until the reserve Bank of Australia stepped in and decided, perhaps for ego and power reasons, to be the most aggressive central bank in the world.

We have spoken before of how the RBA raised rates three times after the GFC had started. Yes, very slow to respond. It had to wait for the economic data to show the global shock that was then occurring. Data is always one to two months behind reality. This was an astoundingly poor performance by the RBA to say the least.

After the follow up panic rate cuts, the RBA then in 2009 began a bizarre tightening cycle.

It kept citing the aggregate data which included the booming resources sector. Why could the RBA not distinguish between the impact the resources boom was having on the data, and the real domestic economy where 97% of Australians live? Which had been teetering on the edge and had only just begun to recover.

The economy was indeed recovering as you can see in the declining unemployment rate immediately after the 2009 shock. This shock was largely one of sentiment. The effects of the US created Global Financial Crisis, were buffered form Australia by China continuing to manage its economy well. Things were beginning to look up. But no. The RBA had to refer to its 1960s thinking game plan and hike rates aggressively. The only central bank in the world unaware enough to do so. Simply because it thought the resources boom would cause inflation in the wider economy.

How could that possibly be the case? Inflation in a struggling economy. Inflation in a new globally price competitive economy. It was never going to happen. I said so in real time. This is not after the fact analysis. This was obvious in real time. Why is the RBA the least economically aware central bank in the world? Answer; the Governor is appointed from staff.

So the domestic economy was again driven back to its knees, and unemployment turned around and again began to trend higher. Real damage was done to real hard working Australians. Yet Stevens maintained his pomposity and even gave himself the highest central banker salary in the world. If there was ever a need to review and overturn a national institution, then it is the RBA.

The only accountability is a walk-through Senate review. Meanwhile Australian families suffered distress, marital break down, increased crime and even homelessness. This is what happens when people lose their jobs. This is what happens when the unemployment rate goes up. Real pain, real harm was done to our nation.

No honest critique in the media or among the major banks and financial institutions? Why?

The real answer is because the major Australian banks enjoy great profitability from bond trading and the protection of the RBA, and it is the case that the RBA has in the past, diminished bond trading activity with banks that made negative comments about it. When as a Senior Strategist Asia for BNP Paribas, I appropriately criticised the RBA, as is what happens in a healthy financial market system. Pressure was exerted, messages were sent, from the RBA to our bond trading desk?

This is why the RBA and RBA Governors have such an easy un-critiqued run in this country. Something that does not happen in other countries.

The media deriving its financial market information and views and comments primarily from the major banks, misses the more distant view of what is going on here. Without open and honest critique of our RBA, we can never have a truly world’s best practice central bank like other nations.

The RBA will float along in a global environment of improving economic growth accompanied by low inflation as we have been forecasting. When next things go awry however, the RBA will again be seen to be wanting. The RBA all again let the people down.

First step to avoiding chronic below trend and potential growth in Australia, is to have the RBA Governor appointed from outside the bank, to avoid the stagnancy of thinking and the intellectual in-breeding now apparent.

Australia, Australians, deserve better. Un-employment should be sub-5.00% as it has clearly displayed it has the capacity to achieve. Our Prime Minister and Treasurer need to address this issue. It should have been addressed before the recent internal passing of the baton. It should be immediately addressed now!

Please circulate this article. If the PM will not do anything about all of us having to carry a heavier load than otherwise would be the case, then we need to. A groundswell of people power for change at the RBA is what is required.

Clifford Bennett

Related Posts

Number of centenarians in Australia soars sixfold, adding new dimension to housing crisis

The number of Australians aged 100 or over has reached a record high of 6,192, a sixfold…

- 23 Apr, 2024

WA house price boom not just about migrants – another population’s exploding

There are now a record 642 centenarians in Western Australia compared to just 67 in 199…

- 22 Apr, 2024

The incentives needed to boost investor activity in Australia

With Australia’s annual rent bill blowing out by $44 billion per annum over the last…

- 11 Apr, 2024

Become a Member Today!

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.