- 10 Nov, 2017

Did Superannuation Really Deliver Single Digit Growth Over 10 Years??

Australian superannuation funds have a much higher exposure to volatile share markets than almost any comparable country without earning higher returns, according to new figures.

The OECD’s annual Pension Markets in Focus report has found that Australia’s pension (superannuation) system had 51 per cent of its assets in shares in June 2016, more than twice the weighting of Canada, with 23 per cent.

The US had 31 per cent, the UK 14 per cent and Denmark 22 per cent.

- Over 2015-6 Australian pension funds returned 1.9 per cent after inflation compared with 7.2 per cent in the Netherlands, 4 per cent in Canada, 5.9 per cent in Denmark and 3 per cent for the average of OECD countries.

- Over a five year period Australian real returns were at the higher end of the scale, 5.8 per cent, but still below Canada’s 6.9 per cent and a number of other countries that returned more than 6 per cent.

- Returns over 10 years were influenced by the GFC and Australia’s rate came in at a low 2.9 per cent!

Women's superannuation not so super: The $120,000 gender gap

The latest breakdown of Australia's $2.3 trillion superannuation pie confirms what we have known for a long time. Men do much better out of super than women.

According to the Association of Superannuation Funds of Australia (ASFA), the average superannuation balance for women last year was $68,000 and for men, $112,000. Women who retired in 2016 had an average super balance of $157,000 while men had $271,000.

Across all age groups, from workers just starting out to retirees, the mean superannuation account balance for men is $112,000 and just $68,000 for women.

In a nutshell, nowhere near enough to live on for both sexes, meaning both men and women have to rely heavily on the age pension to top up their retirement incomes.

Putting that to one side, women who retired last year still had an average $120,000 less in their super than men.

Australian job ads lift again

Australian job advertisements rose strongly in October, more than reversing a 0.7% decline in September.

David Plank, Head of Australian Economics at ANZ, said that as a lead indicator on future employment growth, the result is consistent with ongoing labour market strength.

“The bounce in job advertisements in October is consistent with elevated business conditions and capacity utilisation,” he says.

The strong lift in employment, the fastest seen in many years, saw Australia’s unemployment rate fall to 5.5%, the lowest level since February 2013.

7 Major Projects Add $12bn To Brisbane’s Economy!

A wave of major development and infrastructure projects coupled with an improving economic outlook promises to create increasing employment, tourism and commercial real estate opportunities in Queensland’s capital.

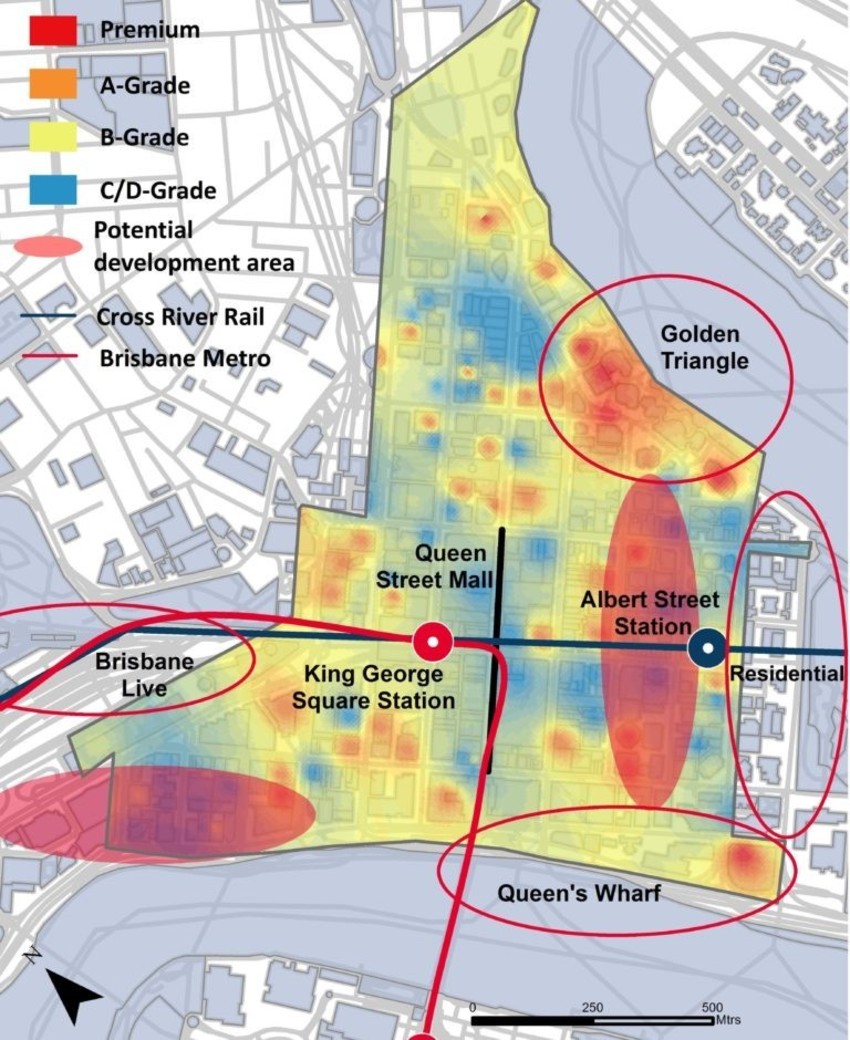

Projects approved and under construction are the Edward St revitalisation, Howard Smith Wharves redevelopment, the Brisbane Quarter, Queen’s Wharf casino precinct and the Cross-River Rail. The Brisbane Metro transport system and Brisbane Live entertainment precinct are yet to be approved.

At the industry sector level, four of the top five industry sectors are forecast to show stronger growth, especially for IMT and professional services.Jobs are also expected to increase in the CBD and fringe markets, with an estimated 65,000 jobs over the next decade.

Brisbane is also expected to benefit from a 70 per cent increase in international tourist visitor nights in the next decade, leading to over 105 million visitor nights in 2026-27.

Proposed development and infrastructure projects targeting Brisbane CBD over the next 10 years are valued at over $12.4 billion, part of over $20 billion in projects across the city.

“Together they will help deliver the Council’s vision of establishing Brisbane as a ‘new world city’,” Brown said.

So . . . with:

- Our Superannuation system barely keeping pace with inflation over the last 10 years

- There is an increasing gender gap between men and women in Super

- Business conditions and therefore job security looking up

- Queensland at the forefront of commercial and business investment over the coming decade

What better time, to securely plan for your financial future, by safely invest in residential property, with the experts for 23+ years now! Have a great weekend and catch you next week!

Troy Gunasekera

Related Posts

The incentives needed to boost investor activity in Australia

With Australia’s annual rent bill blowing out by $44 billion per annum over the last…

- 11 Apr, 2024

Timing the Property Market: Myths, Methods, and Must-dos

Timing the property market is a concept that intrigues and challenges many Australian…

- 09 Apr, 2024

'Astonishing' population surge to push property prices even higher

A surprise fall in unemployment could put pressure on interest rates but property prices…

- 21 Mar, 2024

Become a Member Today!

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.