- 29 Jul, 2016

What Will Australia’s Low Inflation Reading Mean For Interest Rates And Property Markets?

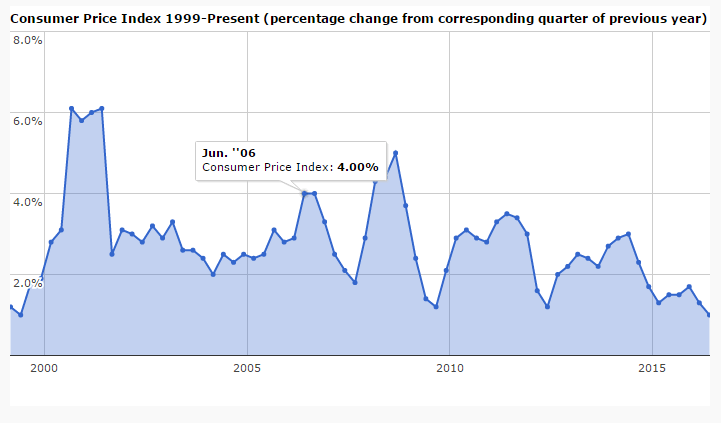

Consumer prices in Australia rose 1.0 percent through the year to the June quarter of 2016 from 1.3 percent in the previous quarter and slightly below market consensus. It was the lowest inflation rate since the second quarter 1999. On a quarterly basis, consumer prices rose 0.4 percent, following a 0.2 percent drop in the March quarter and in line with expectations.

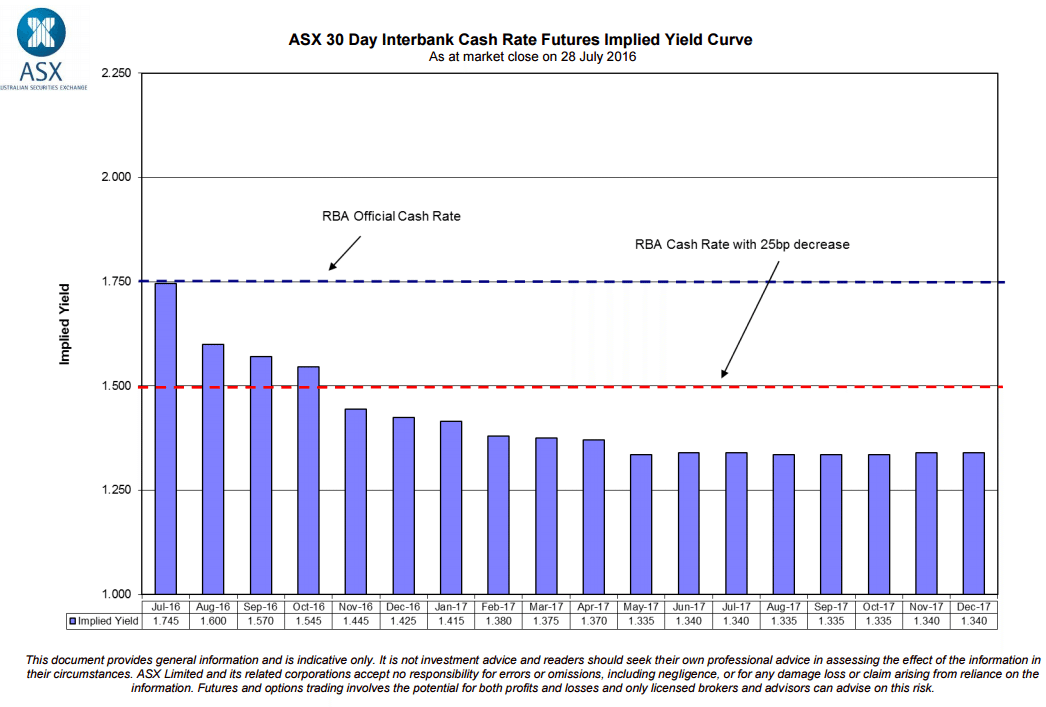

Looking at the markets on the futures for the cash rate, there is still a high probability of the rate dropping another 0.25% by the end of the year!

There was also more focus on our property markets this week, in terms of superannuation options.

The family home may for many hold the overlooked value when it comes to fund or financially support their retirement savings, an option strengthened by constant tinkering and growing complexity of superannuation.

Peter Szabo, Homesafe Solutions managing director, said that all these issues would rather turn Australians to the family home as an option "seeing it as a better, simpler and relatively more secure alternative".

The provider of the retirement solutions noted that the ongoing fiddling with the legislation around superannuation fuelled a lack of confidence in the system and drove Australians to seek other alternatives despite the federal government's objectives to strongly encourage people to fund their own retirement through industry, retail, corporate and SMSF structures.

Peter Szabo, Homesafe Solutions managing director, said that all these issues would rather turn Australians to the family home as an option "seeing it as a better, simpler and relatively more secure alternative".

As such, the overlooked value stored in the family house, an equity that can be accessed to supplement the underfunded superannuants and low income retirees, was expected to gain more significance.

"Continuing socio and economic uncertainty is the new norm for today's working Australians that these factors will impact on their ability to contribute sufficiently to superannuation," he said.

"Add in constant government tinkering with the superannuation system and owning a family home can prove to be a much needed asset lifesaver for ongoing financial wellbeing when it is time to face an underfunded retirement."

And finally, when you couple this with the updated facts through that 1 in 10 capital city home sales over the past year were over $1 million, we can see our property markets continuing to be very health moving forwards!

Property Club members have continued to benefit from our extensive Research and more, with 5,000+ members in our Millionaires Club!

Property Club members are having a lot of success with Club research assisting them to acquire a residential property portfolio, that will give them more choices in retirement!

Make sure you contact your Property Mentor to assist you to catch the wave as well!

Have a great weekend and catch you next week!

Warm Regards,

Troy Gunasekera National Manager Property Club

Related Posts

Number of centenarians in Australia soars sixfold, adding new dimension to housing crisis

The number of Australians aged 100 or over has reached a record high of 6,192, a sixfold…

- 22 Apr, 2024

WA house price boom not just about migrants – another population’s exploding

There are now a record 642 centenarians in Western Australia compared to just 67 in 199…

- 22 Apr, 2024

The incentives needed to boost investor activity in Australia

With Australia’s annual rent bill blowing out by $44 billion per annum over the last…

- 11 Apr, 2024

Become a Member Today!

Our mission is to help the average Australian learn the property market dynamics and discover the amazing opportunities that exist in real estate.